Our Mission

AIGA advances design as a professional craft, strategic advantage, and vital cultural force.

In The News

Best Book and Cover Designs of 2022 Revealed: Remarkable Winners Announced for AIGA’s 50 Books | 50 Covers Competition

Read MoreExplore AIGA

Events

Meet the Community

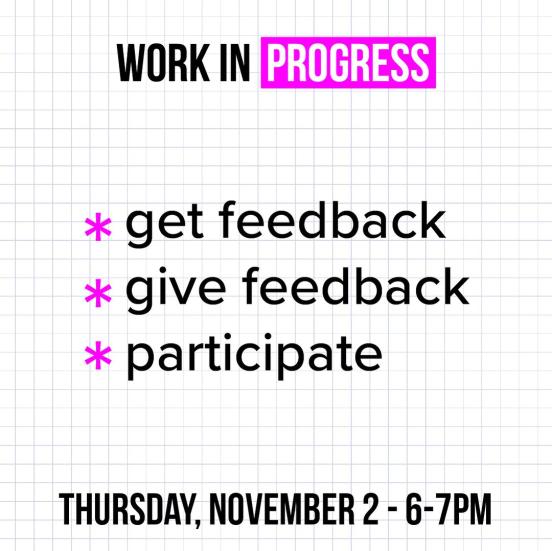

View more eventsDec

7

Virtual | 6

AIGA Portland's "WIP - Work in Progress"

An opportunity for designers to give & receive constructive feedback on creative work prior to showing their team/client/stakeholders.

View Details

Apr 25, 2024 | Atlanta

Buzz Happy Hour | Mutation Sandy Springs Edition - April 2024

Apr 25, 2024 | Cleveland

DESIGN JAM: AIGA Cleveland's April Community Meeting

Apr 26, 2024 | Chicago

Co-Working Days: April 2024

Apr 27, 2024 | San Francisco

WILD April East Bay Meetup: Kinfolx Oakland

Being a member of AIGA has given me access to educational resources for my professional development and business opportunities...it's opened the door to meaningful relationships with a diverse group of dedicated people with whom I'm proud to be in community with.

John Hornsby

AIGA Asheville

![John Hornsby Headshot [field.undefined]](/sites/default/files/styles/one_fourth_width_320/public/John-Hornsby-1000x000.jpg?itok=jv7CFC6f)

AIGA Chapters

Be a part of our local communities

Find Your Local Chapter

Support your local creative community—when you become a member and select a chapter, a portion of your dues goes to funding your chapter’s programming and initiatives.

Find Your Dream Job

Visit AIGA Design Jobs to make your next move. Free access to view and apply for AIGA members.

Empowering Designers to Change the World

Join today to access networking through your local chapter and a wide variety of local and national programs and events.

About AIGA MembershipMore from AIGA

Resources for Everyone

Get the tools you need to succeed in your career. Explore our collection of resources for freelancers, business owners, design educators, students, in-house designers, and other design professions.

Visit the Resource Collection

Curated Collections for Designers

Featured Resources

Join AIGA and Become a Member Today!

Join today to access networking through your local chapter and a wide variety of local and national programs and events.

Become a Member